Downtown Phoenix is one of the more stable real estate markets. In our 2013 October November Market Forecast, Mike Orr mentioned three downtown zip codes, 85003, 85004 and 85006, as among the most stable zip codes in Maricopa county. We believe it has to do with one major factor… jobs. Jobs pay wages and wages pay mortgages.

Downtown Phoenix is one of the more stable real estate markets. In our 2013 October November Market Forecast, Mike Orr mentioned three downtown zip codes, 85003, 85004 and 85006, as among the most stable zip codes in Maricopa county. We believe it has to do with one major factor… jobs. Jobs pay wages and wages pay mortgages.

Lets pour out some quick stats and take a look at what they mean:

- Number of Homes/Condos currently on the market: 305 with 188 being single family homes

- Number of properties in escrow (Pending): 123 with 84 being SFH and 12 being condo/lofts.

- Number of properties sold in October: 35 with 22 being homes and 13 condo/lofts

- Highest priced home sold in October: $490,000

- Highest priced condo sold in October: $288,000

- Most active prices range for sold homes: $150-$200K and condos in the $110-$150K range.

Real Estate Market Conclusions from The Urban Team

Sales have been slow since August 2013, especially between September 1st and October 20th. There are many reasons, real and perceived, for the slow down including:

- Families prefer to play the housing version of musical chairs before the school year starts. Thus they are done in mid-July.

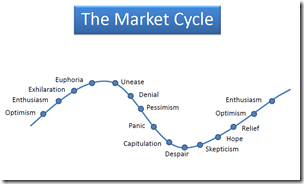

On the market cycle graph to the right most experts feel a number of people still fall into the skepticism category. This is or can be due to a number of factors:

On the market cycle graph to the right most experts feel a number of people still fall into the skepticism category. This is or can be due to a number of factors:

- Some do not feel the housing recover is real.

- Some feel there is a shadow inventory. You can read more about this on our site at: Phoenix Shadow Inventory, fact or fiction.

- The rapid rise in home prices looks a lot like 2004-2007.

- The government shutdown brought down consumer confidence.

- Buyers got frustrated putting in offers and being beat out by investors and cash buyers.

Despite these reasons, we are seeing a number of people moving forward and looking for homes. Some of these are folks who short sold their homes a few years ago and can now qualify for a new mortgage, some are afraid interest rates will jump in 2014 and others are simply ready.

We see single family home sales far out pacing condo/loft. This is largely due to exorbitant HOA fees. For years HOA fees were generally in the 30-40 cents per square foot range or about $250-$400 for the average condo/loft home. Today it is not uncommon to see HOA fees in the $500-$900 range.

The newer/higher rates were often necessary to overcome past financial problems. However, like taxes, once they go up it is hard to get them back down.

With interest rates near 4%, a single family home without an HOA makes sense. See the example below

Example of Non-HOA Buying Power: There is a 1600 sqft loft at Orpheum Lofts with a $993 monthly HOA fee. $993.00 will pay the mortgage on a nearly $200,000 home. The buyer has to factor in $350,000, the asking price of the condo, plus the $993.00 HOA., Put that against a home for $350,000 without the HOA fee and ask yoiurself what makes more sense. Plus, if it is a home in one of our 35 historic districts, the property taxes with be 1/2 as much as a similarly priced condo/loft.

We see the downtown market gaining stability and experience growth. Housing needs in the region are on the rise. In addition to the demands ASU, UA, TGen, City/State Government and other private sector employers are placing on the area, there are lots of new jobs coming.

Exciting Downtown Phoenix Jobs News:

Mayor Stanton just announced a new downtown partnership with Tampa FL based SynDaver Labs. The detail of the partnership belong in another post but the estimated 800+ new jobs fits nicely here. It is hard to see how demand will not keep the downtown sector strong and vital. In addition, we believe outline areas (South of Indian School and east of 16th Street to experience more revitalization as families call these neighborhoods home.

A Caution for People Selling Their Home in Downtown Phoenix:

We have a caution for home sellers. The rapid upswing in home values ended last July. The slow down reasons, noted above, have not gone away. Consumer confidence is still pretty fragile. Our advise is to be reasonable in your pricing. Despite the significant demand, downtown home buyers are darn savvy and generally unwilling to overpay.

If you want to know the current value of your home, try our Market Snapshot system. People tell us it is a wonderful tool for seeing what’s happening in the neighborhood. You can sign up for Market Snapshot on our home page. It is located in the right side column. Naturally, we are happy to do a personal home value analysis for you too. Just give us a call or toss an email our way.

Thanks so for spending your time with us. Time is special and you spending it on Urban Connection is a real gift to us.

Gene Urban & Ron Urban

The Urban Team at Realty Executives

Gene@UrbanTeamAZ.co, or Ron@UrbanTeamAZ.com

602-234-5777

connecting people to the perfect place for over 20 years.