For the first time in 18 months we are reporting a some what quite Phoenix real estate market. Before I say anything else, this is not a bad thing; In fact it is refreshingly normal. Now that we have that out of the way, we, The Urban Team at Realty Executives, welcome you to our Phoenix real estate market report for August 2013.

A look at the past 18 months in Phoenix Real Estate…

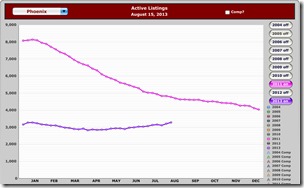

Since February of 2012 the greater Phoenix real estate market has been sizzling hot. As we’ve discussed in past articles, it’s a supply and demand thing. The number of available homes (active listings) fell like crazy in 2011 while home buyers flooded the market. We saw multiple offers and prices jumped like a frog on crack.

Since February of 2012 the greater Phoenix real estate market has been sizzling hot. As we’ve discussed in past articles, it’s a supply and demand thing. The number of available homes (active listings) fell like crazy in 2011 while home buyers flooded the market. We saw multiple offers and prices jumped like a frog on crack.

The overall effect of the past 18 months has been a 30%+ rise in home values and consistently low inventory. Just look at the graph to the right to see how the inventory levels dropped in 2011 and remained low.

If you were a home buyer during February 2012 – July 2013 you either jumped for joy at getting a killer home for a good price or got frustrated by making offers on homes someone else got. There were lots of cash buyers pushing the price envelope and lots more people looking than selling. As soon as a decent home came to market it was gone and even dog ugly homes (no offence to dogs) didn’t last too long.

The August 2013 Phoenix Real Estate Market

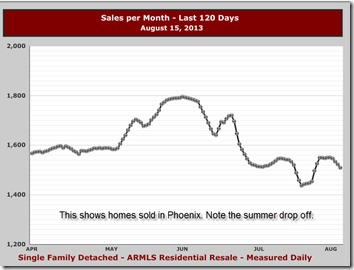

We saw a twinkle of change in mid-July 2013 that is continuing in August/September . Inventory levels are slowly rising and agents are reporting fewer showings and sales. One might think this is bad news or a sign of trouble. In fact this trend is a wonderful sign of an ordinary Phoenix real estate market. We need normal for a while.

Why  Did The Phoenix Real Estate Market Slow Down?

Did The Phoenix Real Estate Market Slow Down?

We need to look at the supply and demand model to see why an August slow-down is normal. Who buys homes in Phoenix? Families, single people, investors, winter-visitors, people retiring from the cold and a smattering of others. What changes with these various buyers in mid-July and August?

- Family types generally want to be in their new home before school starts. That means completing the sales process before mid-August and preferably by the end of July.

- Winter visitors are just that… winter visitors. They stop buying in May or so.

- Locals leave Phoenix every weekend they can in August and early September. Buying a home is not nearly as much fun as body surfing in San Diego or being a foodie in San Francisco.

- Investors are having a hard time finding deals. Many have moved on to other States where their revovery is just starting. FYI: Arizona was the first state to experience a recovery and it took-hold back in 2011.

- Downtown home buyers often are associated with ASU and UA. Like family home buyers, they want to be in place by mid-August.

What is the Phoenix real estate market going to do in Q3 & Q4 2013?

No one can predict with certainty how the last half of 2013’s real estate market will perform. That said, the Urban Team predicts:

We see a fairly soft September-January market. Inventory levels are still lower than normal and demand is fairly modest. The combination of the two should keep values close to current levels with some slight gains in the more popular markets. We expect Tempe, Chandler, Gilbert, downtown Phoenix, north and central Phoenix to all hold their values. Some of the outline markets may lose a little ground now that most investors have moved to greener pastures.

There are a number of variables that can/will affect the late 2013 market.

- Mortgage interest rates. When rates went up in late July a lot of people freaked. The problem, as I see it, is perception. A lot of younger home buyers have only known interest rates below 5%. They don’t know that 8% rates are historically normal and rates under 5% are an anomaly.

- FHA & Conventional Loan changes will affect people who did short sales and foreclosures. FHA just announced some loan requirement changes for people who went through a short sale. The modifications may make it easier for many people to qualify for a loan sooner than expected. This info and some better conventional loan products could spur people to buy why prices are still relatively low.

- Jobs, Jobs, Jobs. According to the Bureau of Labor Statistics, the jobless rate in Phoenix is going down. In mid-2010 it was as high as 10.8% and July 2013’s numbers were 7-9-8%. Our sense is Phoenix has a broader labor market today than in the past. Bio-Med has added depth to the downtown sector while technology, healthcare and tourism have given strength to Scottsdale and the east Valley. The strengthening heartbeat of the building trades will certainly aid in the health of the west valley.

- Inflation… the big unknown. No one wants to talk about inflation, especially if they are in politics. Many top economists warn of impeding inflationary times. This may not affect the real estate market in late 2013 yet I’d keep senses alert next year. BTW… Warren Buffet often suggests real estate as a buffer for inflation. You can learn more about his thoughts here. http://www.youtube.com/watch?v=PVZhbO73DuQ

Conclusions about the Phoenix Real Estate Market 2013

The August through November Phoenix real estate market will continue to be vital. We don’t expect to see home value gains or loses… stability is the word on the street. We believe many of the up-coming home buyers will be people who went through a short sale in 2008-2010 and can once again qualify for a loan.

For The Home Seller: We do not believe home values will be rising much if any in the last half of 2013. This simply means you probably won’t be leaving money on the table selling your house if you sell it now or in the next few months. There is a chance of modest increases in the spring of 2014 but rising interest rates and fewer cash buyers will likely keep gains in the single digit range. Move-in ready homes that have been well maintained will continue to get stronger offers while over-priced houses will likely linger on the market.

For Home Buyers: The late summer and fall offer home buyers a good opportunity to buy right. Homes are staying on the market longer, home sellers get a little anxious and the competition from other buyers is relatively low. NOTE: Inventory levels are still quite low so when we say things like “lower competition and longer time on market” is a relative term. In general the market is still pretty competitive… just not as much as the winter/spring season. If you went through a short sale or foreclosure and wonder if you can qualify for a loan… you may be pleasantly surprised with your options.

Hope this has been helpful.

Gene Urban and Ron Urban

The Urban Team at Realty Executives

602-234-5777

connecting people to the perfect place for over 20 years.

The information in this article is the opinion and property of the Urban Team. All rights reserved.