Let’s talk FICO scores today with a focus on how to improve my FICO score. . Before we go on, I have to say I am a Realtor, not a credit specialist. However, I know some credit people who do know what they are talking about.

Let’s talk FICO scores today with a focus on how to improve my FICO score. . Before we go on, I have to say I am a Realtor, not a credit specialist. However, I know some credit people who do know what they are talking about.

FICO scores are a hot topic these days as more and more people who lost their homes or went through a short sale are pondering their current options. In this article we’ll begin with a look at what makes up your FICO score and move on to ways you can improve you FICO score.

What Is a FICO Score?

A company called Fair Issac created the FICO scoring system a few decades ago. Its purpose was and is to rank a person’s credit worthiness so businesses that extend credit can assess the risk. There are actually 3 FICO scores, one from Experian, Transnation and Equifax. FICO scores range from 300 (really sucky) to 850 (golden) and are used by an estimated 90% of those who extend credit and give out loans.

COOL TRIVIA: Years ago the company now call Equifax used Welcome Wagon Representatives to help gather credit information.

What is my FICO score based on?

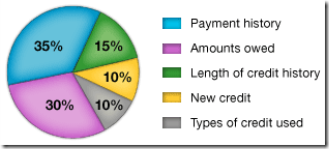

FICO scores, according to FICO.com, are based on 5 major factors. Each of the 5 have different levels of important. Below is a chart that shows the important “stuff” and weight each one carries on your FICO score.

As you can see, payment history and the amount you owe are the biggies. Thus, late payments will kick you in the credit fanny…. if there is such a thing. The amount of outstanding credit is naturally a big risk factor… no surprise there. The length of credit history comes as a surprise to some and get’s others in trouble.

NOTE: FICO scores are heavily influenced by how long you’ve had your credit cards. Some people, in an effort to get their scores up a bit, close all their seldom used accounts. This is considered bad form by FICO and you can be penalized, especially if you close very old accounts.

How can I improve my FICO score so I can get that sweet home I want?

How can I improve my FICO score so I can get that sweet home I want?

According to the folks at MyFico.com, you can do a lot to improve your FICO score. If you just look at the chart and think a bit I bet you’ll come up with some of the basic points they’ll tell you.

- Review your credit report and fix any errors you find.

- Pay your bills on time.

- Set up payment reminders in your calendar if you find you can’t remember.

- Pay off as much debt as possible.

- Be financially responsible.

- Add additional credit cards and debt prudently. An excessive number of credit cards is not your friend.

Naturally, we’ve just touched on the subject of FICO and ways to improve your score. There are lots of on-line sites that can help you. However, be careful because there are a lot of scammers out there too.

The Federal Trade Commission has a site that may provide you guidance and help. You can find it at: http://www.consumer.ftc.gov/articles/0058-credit-repair-how-help-yourself. We’ve also been told that http://www.myfico.com/ has a lot of information that many found helpful. Just be careful with any online sites and do your due-diligence on these companies.

Enjoy,

Gene Urban

The Urban Team at Realty Executives

602-234-5777

Gene@UrbanTeamAZ.com